Credit Karma offers free credit scores and financial tools to help you better manage your money.

The tools and reporting are simple to use and easy to understand — and quite remarkable for a free service.

So how can Credit Karma can be free when it offers so many valuable features?

Just like network TV is free– it’s all about the ads.

So if you don’t mind having Credit Karma suggest an occasional credit card offer to you, it’s a great service, and totally worth it.

Personally, I’ve used Credit Karma for years to track my credit score. It updates my score monthly and sends me encouraging emails every time my score goes up, It also gives me a nice heads up when something changes on my credit report that I might want to look into.

And instead of just showing a credit score with no explanation, Credit Karma lists the factors that are helping — or hurting — my credit score.

I like the fact that I can get detailed information on my credit report, all in one place, without having to contact the credit bureaus myself.

Now anytime you are looking at using a new service, it’s important to ask questions and be comfortable with the answers. So let’s take a look at some of the features Credit Karma offers, and answer some of the questions you may have.

How Accurate are the Credit Karma Credit Scores?

paragraph

Is My Information Secure on Credit Karma?

Is Credit Karma Really Free? What’s the catch?

Credit Karma Credit Score

CreditKarma is a website that can help you control your finances by providing a report card of sorts. This overview covers your credit report and score, savings account advice, credit card guidance, and other financially specific resources. Unlike other credit reporting sites, you’ll find two major differences that exist in the Credit Karma philosophy:

- There is no monthly trial membership or initial credit card charge for signing up. Yes, it is totally free.

- You are given credit report card. This report outlines the main categories of your credit report like inquiries, past due balances, bankruptcies, etc, based on data from TransUnion and Equifax.

When you log into your account, you will land on a personal dashboard that shows you an immediate credit summary. This includes:

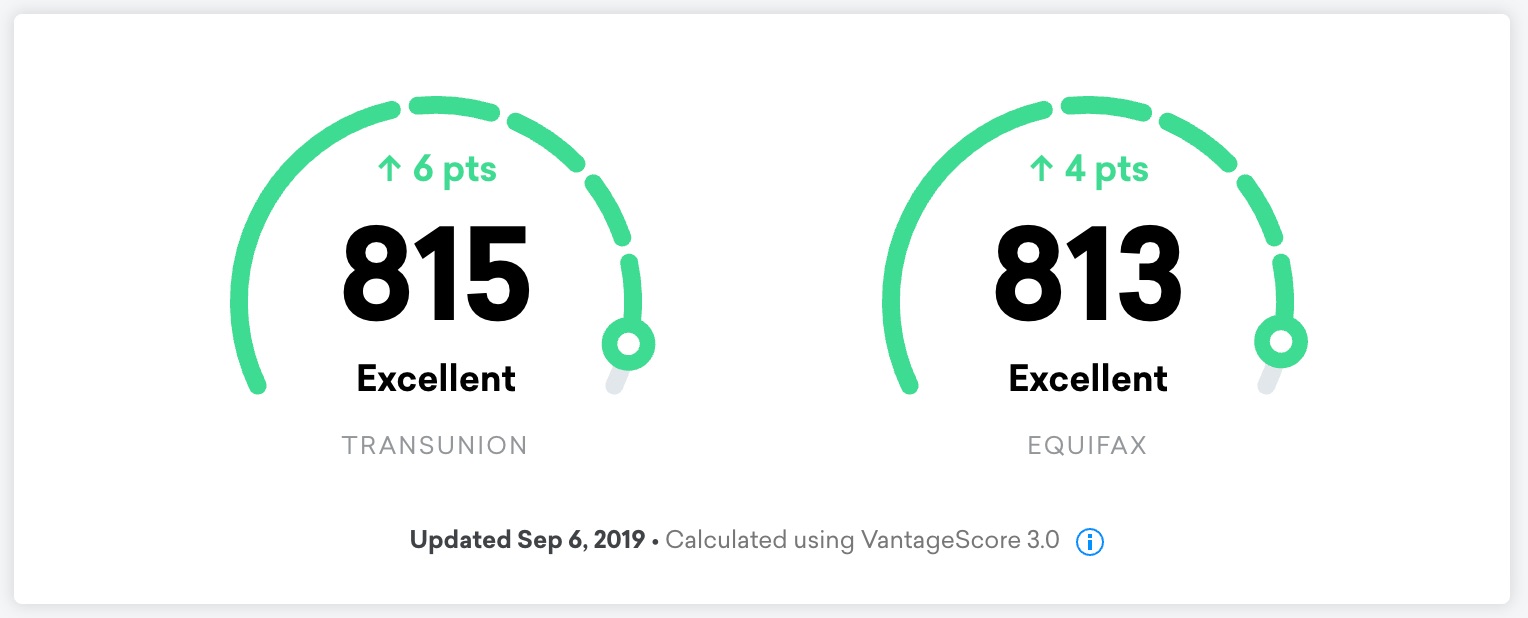

- TransUnion and Equifax Credit Scores–This is not your FICO score, but your credit scores from two of the three major credit bureaus, TransUnion and Equifax (the other is Experian). These will give you a very good idea of where you would stand with your true FICO score, though. You can also see the difference between the information each bureau is receiving to determine where any differences in score may be originating. Here’s a screenshot from my account at Credit Karma:

- Factors Affecting Your Credit Score–These include reported delinquencies, inquiries, collections, credit utilization, and your average age of accounts (AAoA). You will also see the discrepancies (if any exist) between what is being reported to TransUnion and what’s reported to Equifax.

In addition to what you initially see, there are also additional tabs, sections, and features with tons of information about credit, savings, loans, and many other financial topics. The perks that come with signing up for a Credit Karma account are found in some of their neat resources, which you simply can’t find anywhere else.

Is Credit Karma Really Free?

I answered this question above, but it’s worth repeating. Credit Karma is free. There are no trial periods and no credit card is required.

Key Credit Karma Features

Credit Karma offers a lot more than just credit scores. Here is a list of the key features that I find the most useful.

- TransUnion Credit Score: You’ll see your credit score based on credit data at TransUnion. The score is calculated using VantageScore 3.0. You’ll also see a history of changes to your score over time.

- Equifax Credit Score: You also get your credit score based on data maintained by Equifax. This score is also based on the VantageScore 3.0 formula. Because the credit data on file can differ between TransUnion and Equifax, your scores will likely be different as well. In my case, the difference was 11 points.

- Credit Factors: You’ll receive a list of the factors that are either helping or hurting your score. These factors include credit utilization, payment history, derogatory marks in your credit file, the age of your credit history, credit inquiries, and total accounts. We’ll dive into this a bit more below.

- Credit Reports: You can see the details of your credit reports at TransUnion and Equifax. A nice feature is the way this information is presented. Credit reports in their raw form can be difficult to decipher. The information at Credit Karma, however, is very easy to understand.

- Track Your Spending: If you want, you can connect bank accounts and credit cards to your account at Credit Karma. This enables you to track your spending over time. You can categorize your spending for budgeting as well.

- Credit Score Simulator: This tool can be helpful to understand how certain events will affect your credit score. For example, you can get an idea of how applying for a new credit card will affect your score. This can be very useful if you plan to buy or refinance a mortgage and want to avoid lowering your credit score. I’ll cover this feature in more detail below.

- Search for Unclaimed Money: This is a new feature that Credit Karma recently added. You can search for unclaimed money that may belong to you. The search is by state, and you’ll be directed to a state-specific resource where you can conduct an online search.

Credit Simulator

One big aspect of the CreditKarma.com genius is their credit simulation feature. This tool can help you predict how your credit score will be affected by certain actions. Do you plan to close a credit card, or purposely make a late payment because you can’t afford to send the check on time? Well, using this simulator, you can determine whether or not your credit score changes with each action.